Lately I've been getting a few questions from some readers about cash budget specifics. I thought it might be helpful to describe our cash budget system explicitly so it can give you a better idea of how we work together to stick to our budget! If you think of any questions you still have that aren't covered in this post, please message me or comment below and I'd love to help you!

In my opinion, sticking to your budget is a marriage saver, and I want to help you strengthen your marriages! No question about budgets would bother me or put me out, so send them my way! I also promise to keep everything confidential and will not share any names or personal information without permission.

And with that- here's how our cash budget system works:

1. We decide on budget amounts and how many different budgets we have.

I've already been over the big details of how we decide on budgets on a previous post you can read here, but here are some little details to add to that! Kyler and I use the word "budget" for each individual area we put money towards, as in we have a grocery budget, a date night budget, a personal fun money budget etc. We do this because we believe each budget is exclusive and separate from the other. This means I don't take from my grocery budget in order to pay for dinner on date night, or I don't use personal money to pay for car repairs.

The money we take out of the bank for all of our budgets is the lump sum we decided on together after we decided how much should go into each individual budget. We don't call that our budget because we believe it needs more organization than that. Sometimes I think that may be why people struggle with a budget. Just taking out $1000 and saying "I won't spend anymore then this all month!" can make it next to impossible to cover all of your bases while still sticking to that $1000. In our experience we've found that if it's not organized within, it's too easy to overspend in some areas and not have anything left in other needed spots. Solution: make each area into an individual budget.

2. Withdraw from the bank your lump sum and deposit into each individual budget envelope.

This part used to drive me nuts. "I have to go clear to the bank and then organize the money into our 20+ budgets?!" The lfunny part is that this hardly takes any time at all. Maybe 30 minutes total for both only once a month, and mainly because our bank is a 12 minute drive away. Plus that 30 minutes saves us a ton of money, so I think it's pretty worth it. :)

Because of our rule to not use our credit or debit cards for purchases without the agreement of the other spouse, this motivates me to drive to the bank at the 1st of each month so I can proceed with my grocery shopping etc., plus the fact that I want to spend my own personal fun money!!

Tip: Set rules and restrictions together on your budgets that you both agree on. If you're too lenient or unstructured, it'll be too easy to spend and it'll take away from paying off your debts or saving for a big future purchase. You'll be staring at each other at the end of year like "why don't we have $15,000 saved like we thought we would a year ago?" Although this can seem restrictive, the financial freedom you will have because of it makes it all too worth it!

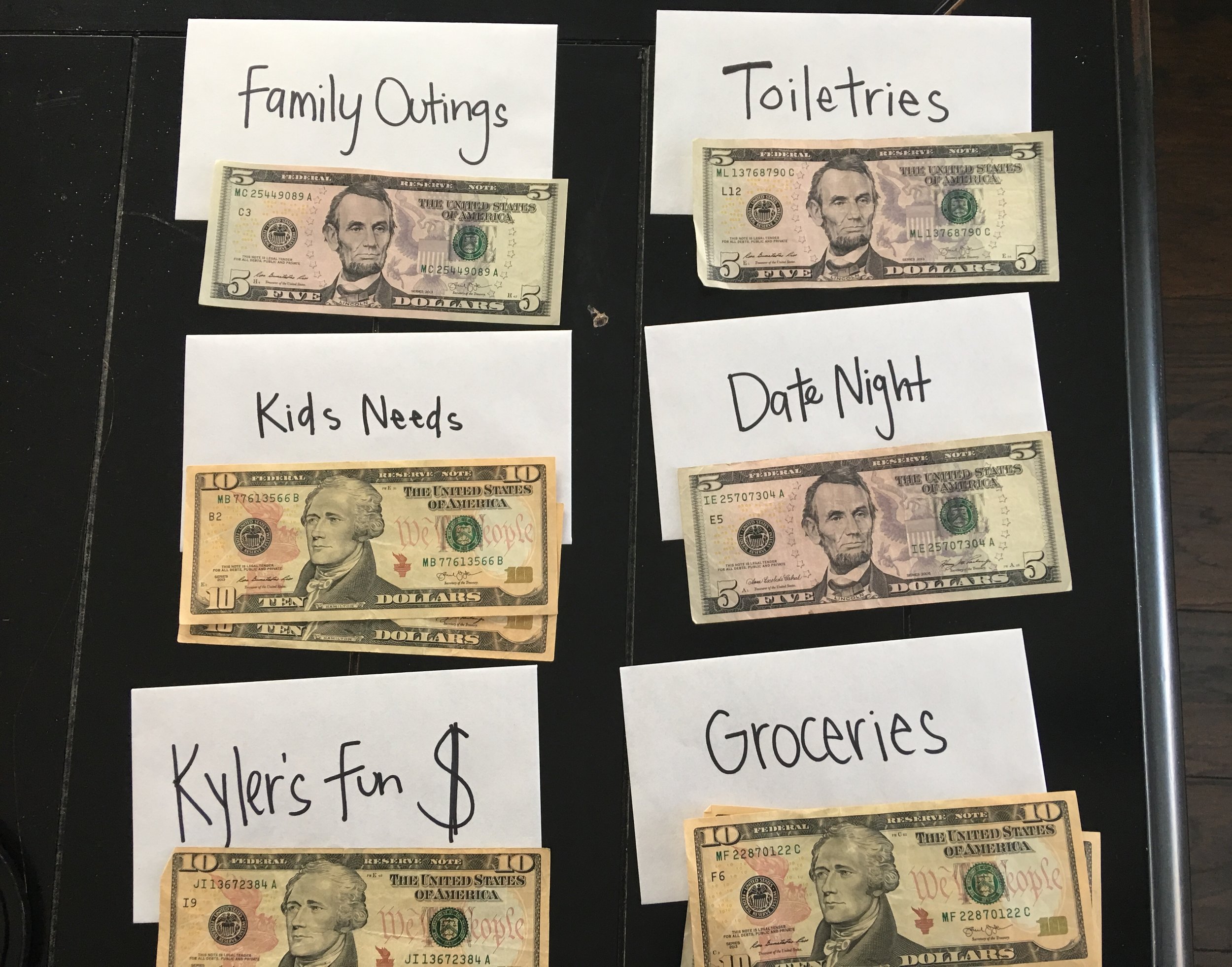

Once I get the cash, I lay it all out on top of each budget envelope to make sure I got the right amount needed. Once it all adds to the right amount everywhere, I either send a picture to Kyler or wait until he comes home to also check through it. This doesn't mean that he doesn't trust me, this step is simply because it's smarter to have a second pair of eyes making sure everything added up to the right amount. You don't want to accidentally short yourself somewhere. If he were to put the money in the budgets, then I'd be the one to do the second check. This is a team effort, so get in the mentality that this is what a team does! We help each other! If you hold tight to the attitude of "my spouse must not trust me" then it makes it more difficult to pull this budgeting system off together. We then put the money away into the envelopes and put each budget in their proper place. The budgets I use frequently go in my wallet, the budgets Kyler uses go in his.

Don't worry guys, we have more than $20 in our grocery budget each month :) these dollar amounts do not reflect our actual budgets

#realtalk: I used to CONSTANTLY say that Kyler didn't trust me when we first started our budgeting process 5 years ago. I mean, if he was making me budget then that's got to mean he didn't trust me with money, right? But guess what, when I really took a look within, I wasn't being trustworthy with the money. I was spending what I wanted to spend, regardless of how it made Kyler feel, because I thought it was too much effort to be restricted on it. I was projecting my dishonesty onto him and making it look as though HE had a problem, when really I did. Although Kyler was trying hard to not act wary of my word when it came to finances, past experience had taught him that I talked a good game (or cried and said sorry a lot) but still did whatever I wanted when it came down to it. We learned that budgeting requires introspection, trust, forgiveness, patience and a lot of open communication. If you keep feeling like your spouse doesn't trust you with money, could it be because you haven't been trustworthy with it in the past? Or are there some things you need to work on in counseling either together or separately to help you both overcome that distrust? Counseling is another marriage saver I am in full support of- I encourage you to never view it as a sign of a failing marriage, but to view it as a sign of two people who will do ANYTHING to make their marriage the greatest!

3. Remember your WHY!

When the going gets tough, the tough get going. I've always loved that saying. When you get tempted to spend outside of your budgets or forego the whole system altogether, remember why you started it in the first place. Don't give in! You're stronger than that!

~~~~~~~~~

Now here are some situations that have popped up for us and how we've chosen to handle them within our budgets:

~~~~~~~~~~~~

4. Online purchases

Since having children, I have really come to love online shopping. It's sometimes quite the hassle taking my kids into stores with me (and don't even get me started on how many stores have tiny shopping carts that don't fit car seats! What the heck Old Navy and Michaels!) But online shopping can be tricky with a cash-in-hand budget! Kyler and I have come up with a system that works for us, but we have found we have to be very disciplined or else it doesn't work. We have an empty envelope budget labeled "online shopping." At the beginning of the month, this envelope is empty. Anytime we make a purchase online, we put the money into the "online shopping" envelope. (It helps if you get a lot of $1's from the bank so you can get a bit more exact when putting money in, otherwise we choose to round up and give more to the "online shopping" envelope than we spent. i.e. We put in $20 if we spent $18, rather than only $15 if we don't have smaller bills. You decide with your spouse what you think is best for your family.) However, this system doesn't work if you forget to put the money you spent online into the "online shopping" envelope. Don't buy online unless you can be disciplined enough to keep track of your spending. Otherwise this is a great way to blow your budgets. Another factor to consider with online shopping is that you often end up paying shipping prices for items. We consider shipping a part of the total cost, so if I bought a $15 shirt online with $2.99 shipping, I don't put $15 into the "online shopping" envelope, I put $18. Therefore, it costs me a little more to online shop, but that's up to you to decide if using your money for shipping is worth the convenience. As long as you stick within your budget, do what works for you!

5. Loaning within your budgets

We might occasionally do a "loan" from one budget to another (i.e. We want to buy a couch from KSL. We are $30 short. The couch will likely still not be available in a week when we get more money in the budget. Therefore we borrow (as in leave a note and all- never trust you'll just remember that you borrowed money from somewhere, you likely won't) from another budget (usually our personal ones) until we get the new month money and can pay ourselves back. This is after we've agreed on it together. To "loan" money from any budget besides your personal budget without your spouse knowing becomes deceitful and it's too easy to do it frequently or to forget to pay up afterwards. Proceed with caution when "loaning!"

6. Spending your budget before you get it

Now this is a tricky one too, one that I have been guilty of for sure. Oftentimes I spend my monthly personal fun money within the first few weeks of the month. Now this is fine as long as I stop spending and just wait until I have more money again the next month. However, at times I have been tempted to dip into the future month budget in order to get in on a good sale going on, "just this once." The problem with this is that it's rarely ever a one time thing. Once you do it once, it's easier to do it a second and a third time, until your budgets cease to have any meaning at all. You have to remember how much you spent and then actually remember to take that amount out of your next months budget, and although you tell yourself you'll remember, in my personal experience, it seems to be more often than not that I completely forget. Plus I might as well just use a credit card because I'm spending money I don't physically have in my hand and I've learned that doing that takes away from future savings, adds to debt, and is being dishonest to my husband since I'm not sticking to what I said I'd do. If you were to bring it up to your spouse and they agree it's a good idea and help you remember to pay it back later, I could see this working. But again, I'd personally be wary of making this a habit.

6. Take it seriously

So many of our problems in this life are because we take things too lightly, or we think "that would never happen to us" and we don't set up protection or boundaries to protect us from the possibility. If there is anything I have learned throughout this budgeting process, it's that finances are not something to ignore or pretend aren't a big deal. They are an integral part of marriage, and just another way to show how much care and thought and value we put into our marriage. Too often we think financial infidelity involves large sums of money, like in the thousands or tens of thousands. But I'm sure many of them start by spending $10, $50, $100 here and there behind their spouses back, or by promising to stick to a certain budget amount and then foregoing it, time and time again. It just gets easier and easier to do it, and if you don't learn some restraint, you can destroy your marriage and end up in financial ruin. (I'm not talking about accidentally going a few dollars over one month, or making the occassional mistake of course. I'm talking about the conscious decision (the one I made repeatedly for years and understand all too well) to spend more than you promised you would.) In order for our situation to change, I had to admit that my lack of discipline financially was a problem. Its a terrible trap to fall into, and I really want to help you avoid it!

I hope this detailed look into how we organize and run our cash budget system helps you! Again, I realize that we may have a more conservative approach than others, and it may seem too intense. That's fine, we're all entitled to our opinions! But I CAN promise you that this approach yields BIG rewards- I'm living proof! In addition to the financial freedom and happiness I feel from it, I'm much more pleased with the person I am today- I've learned to stick to my financial word and I've been able to overcome a really big challenge for me. I share all of these things because I know how down and frustrated you might be feeling, and I want you to feel like I do now!

Have any questions I didn't cover in this post? Please email me or comment below and I'd love to give more detail!

Remember- you've got this!

~~~~~~~~~~~~

Previous On a Budget posts:

Finding your WHY for budgeting